Invest with confidence.

Our portfolios balance risk and returns.

The ultimate goal of the investor is to achieve a target wealth with the lowest possible risk. Therefore:

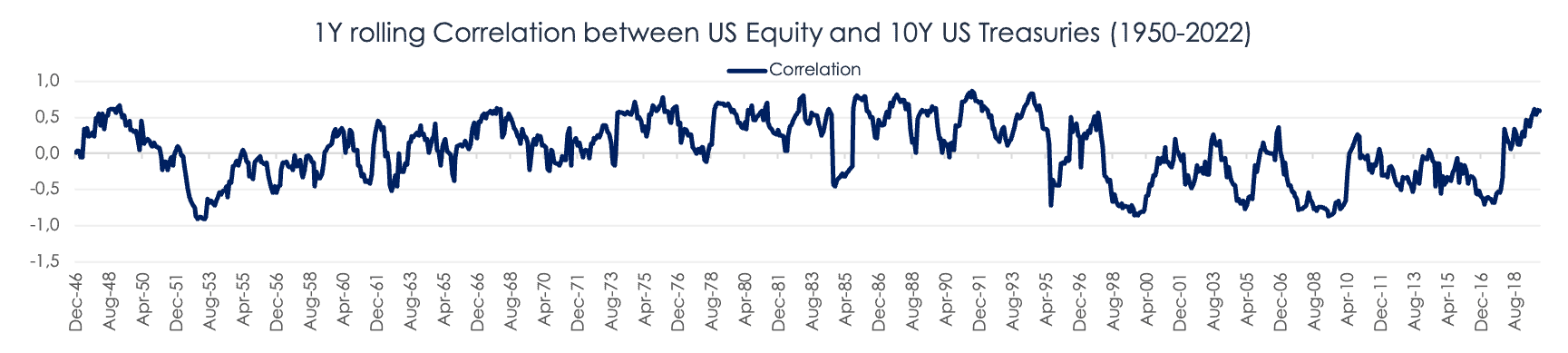

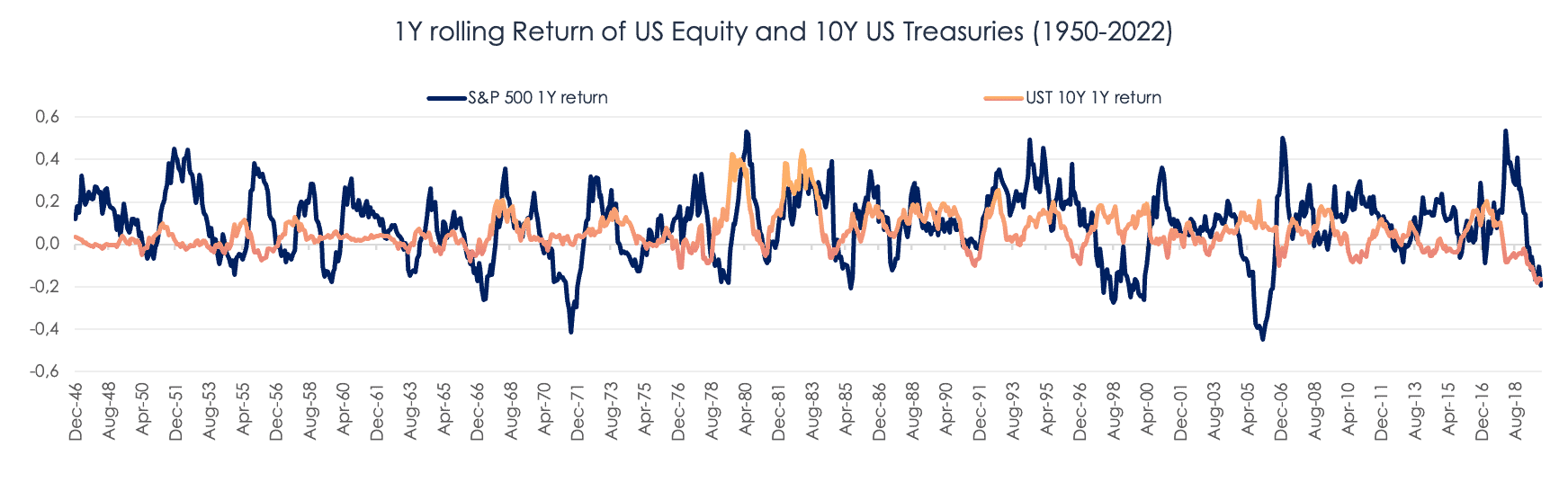

Different asset classes react in different but logical ways in different economic regimes.

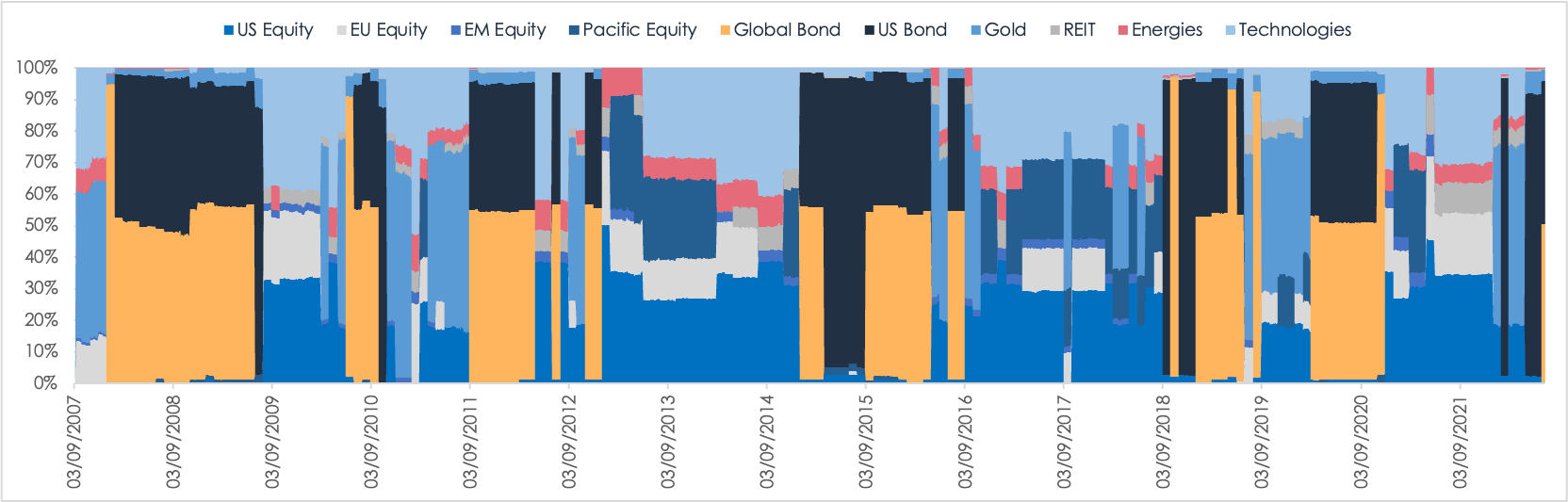

We dynamically adjust portfolio allocation across global asset classes based on market signals and two of the most powerful smart beta factors, momentum and low beta.

Our framework addresses flaws in the traditional application of Modern Portfolio Theory related to Strategic Asset Allocation.

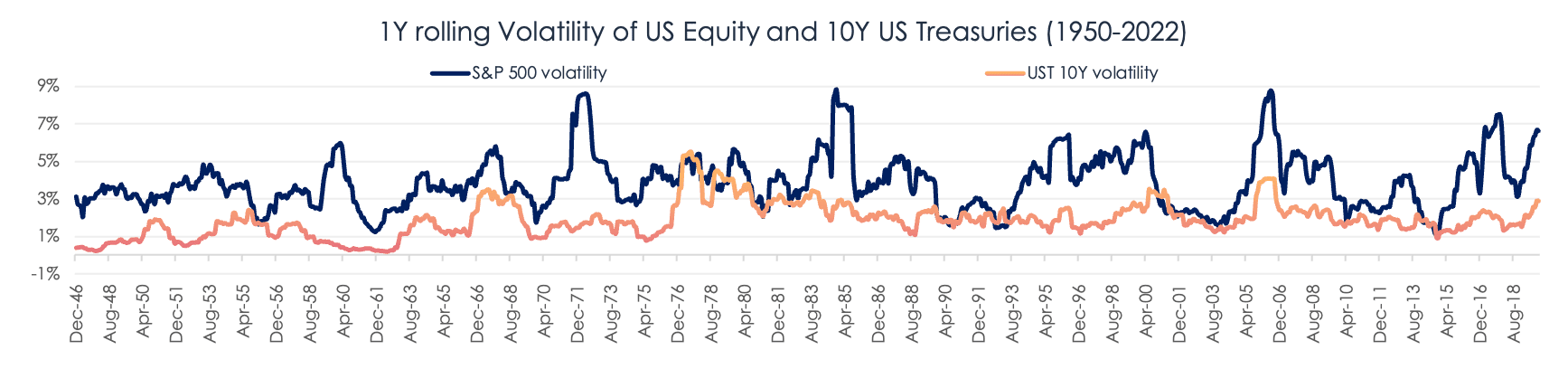

Estimates of parameters for portfolio optimization based on long-term observed average values are shown to be inferior to alternative estimates based on observations over much shorter time frames.

If the investor decides to invest in a passive growth or balanced portfolio, she faces big declines that can catch her just when she needs capital.

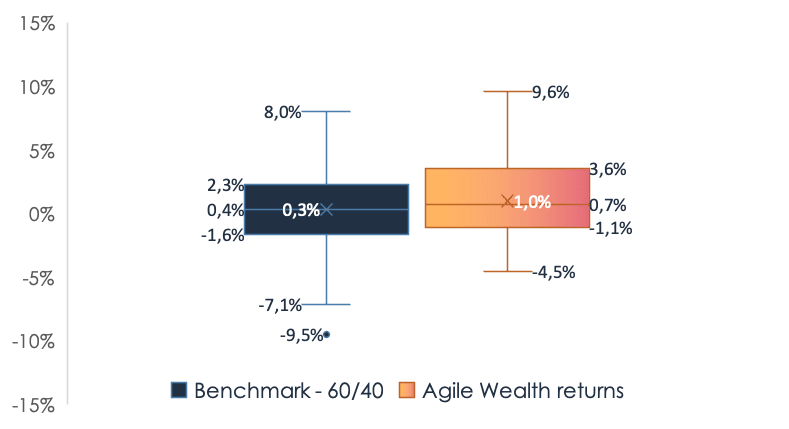

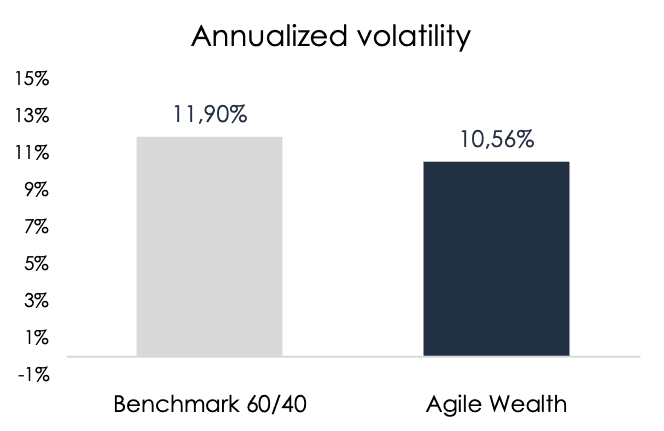

A portfolio with higher volatility has a greater spread of potential returns.

This is true for the positive as well as the negative side of the variance.

Most investors are satisfied with “upside volatility”, but they are much more worried about “downside volatility”, i.e. the probability of extensive declines in the portfolio.

People often choose low-volatility investments because they fear the risk of losing part of their capital. However, not achieving the investment goal is a problem of equal importance!

We want to point out the importance of low-volatility investing and benefiting from the regularity of returns. On this basis, we can build a coherent concept of saving and investing for retirement.

Traditional stock and bond portfolios are constructed to thrive in just two of four major economic regimes that affect global markets. Truly diversified portfolios must be prepared to weather periods of poor global growth, potentially accompanied by large swings in inflation, when both stocks and bonds may flounder.

The objective of one´s portfolio should be to take advantage of all of the available opportunities in global markets. This means seeking out additional, unconventional sources of return outside our borders and in alternative asset classes.

To fulfill described investment mandate, our strategy uses a combination of building blocks to construct an optimal portfolio. These building blocks include:

The Agile Wealth ETF portfolio delivers strong outperformance relative to classic 60/40 (equity/bond) portfolio, a simplified version of Strategic Asset Allocation, which has its potential based on historical statistics.

Convex Investment Management is centered around the idea of “ADAPTIVE INVESTING“. This approach is grounded in the belief that markets are inherently unpredictable and that successful investing requires a flexible and dynamic approach that can adapt to changing market conditions.

This investment philosophy is based on three key principles:

The Cx approach is designed to adapt to changing market conditions by incorporating a diverse range of asset classes, using quantitative market signals to inform investment decisions, and adjusting portfolio allocation dynamically over time.

The Cx approach places a strong emphasis on risk management, using a range of tools and strategies to help manage risk and limit potential losses.

The Cx approach is designed to be implemented using low-cost passive investment vehicles such as index funds or ETFs. This helps reduce investment costs and allows investors to keep more of their returns.

Overall, the Cx investment philosophy is grounded in a belief that markets are complex and unpredictable, and that a flexible and dynamic investment approach is needed to navigate these challenges and generate superior risk-adjusted returns over the long term.